There are several ways to earn a second income. But there are very few ways to earn a second income truly passively. For me, the best way to earn a real passive second income is investing via the stock market.

So, here’s how I’d look to use £12,500 of savings and turn that into a monthly second income worth £583 a month.

My strategy

Here’s what I’d do.

- Brokerage account set-up: Open a brokerage account to facilitate buying and selling stocks. I chose Hargreaves Lansdown because of its ease-of-use and customer service, but there are cheaper brokerage platforms out there. Electing for a Stocks and Shares ISA would mean my second income would be tax-free.

- Defined objectives: It helps to the have an objective in mind and work towards it. If I’m aiming for £583 a month as a second income, I can plan my investments accordingly.

- Research: Conduct thorough research on potential stocks, considering factors like financial health, growth prospects, and dividends, while diversifying my holdings for a balanced and resilient portfolio.

- Review portfolio: It’s important to periodically assess my portfolio’s performance, making adjustments based on market trends and economic conditions.

- Reinvest for compounding: Reinvesting my returns compounds them over time, accelerating portfolio growth.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Compounding

Compounding is one of the most important investing concepts, but it’s often overlooked by novice investors. Essentially it happens when I reinvest my returns year after year.

If I own dividend-paying stocks, this means reinvesting my dividends. However, I can also use companies that reinvest their profits and don’t pay dividends (or only pay small ones), like Amazon or Nvidia, and hope to see the share price grow accordingly.

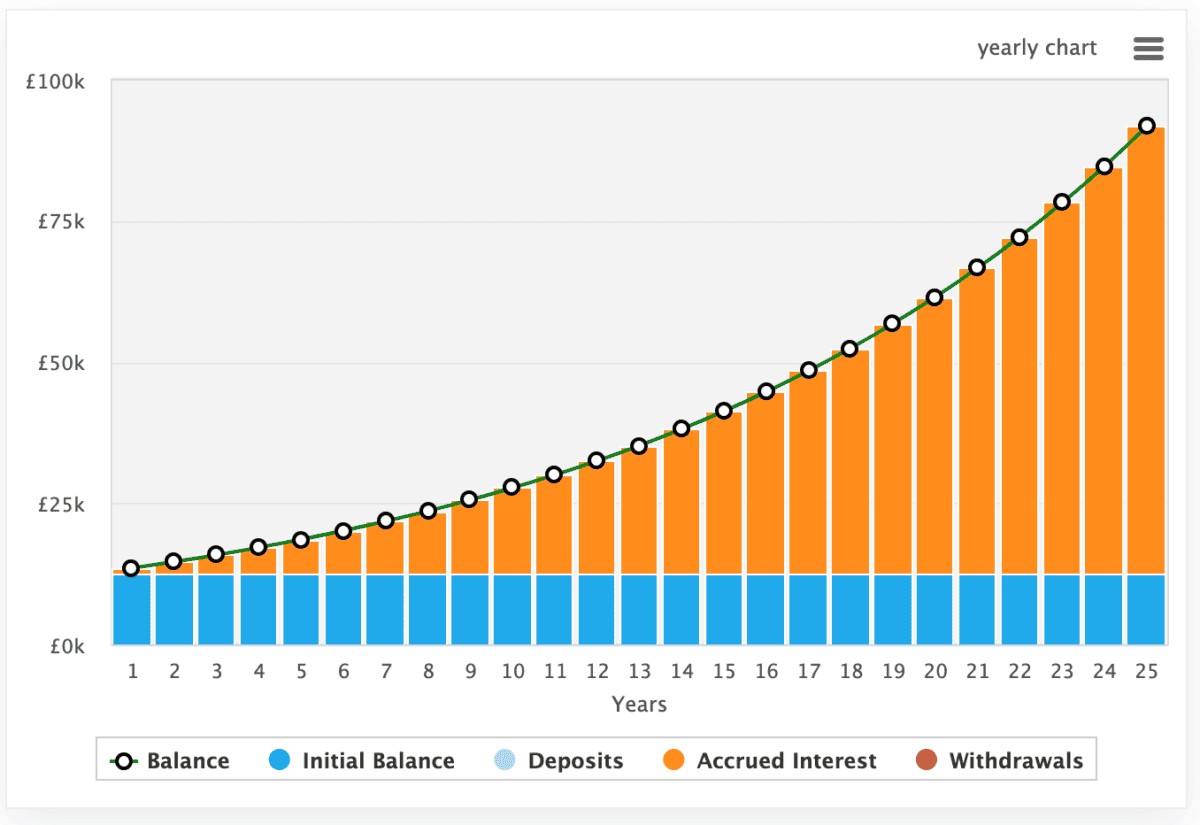

It might not sound like a winning strategy, but it is. It means I’ll start earning interest on my interest. Here’s how that looks in chart form using an 8% annualised return. We can see accrued interest growing exponentially. That’s the impact of compound returns.

At the end of this 25-year period, I’d have just short of £100,000. By investing is dividend-yielding companies like Legal & General, I could easily generate around £7,000 a year or £583 a month.

Building a portfolio

In the above example, I’ve used an 8% annualised yield. That means, on average, my portfolio would be growing at 8% every year. However, if I invest poorly, the value of my investments could fall.

There are two things to remember here. Losses can compound, and if I lose 50%, I’ve got to gain 100% to get back to where I was. This is why Warren Buffett says the first rule of investing is “don’t lose money”.

That’s why it’s important to make sensible investment decisions. These days there’s a host of resources that can help us understand complex financial data, uncover investment opportunities, and make informed investment decisions.

Personally, I like to focus on buying undervalued stocks, and increasingly those with positive momentum. This includes companies like AppLovin, CRISPR Therapeutics, IAG, Meta Platforms and Rolls-Royce — all of which are either in my portfolio, or I’m looking to add them.